Abuja — Chartered Institute of Taxation of Nigeria (CITN) don set records straight say no bank balance ever dey taxed for new tax law — na only some electronic transfers go attract one-off ₦50 stamp duty under the Nigeria Tax Act 2025 wey don start from January 1, 2026.

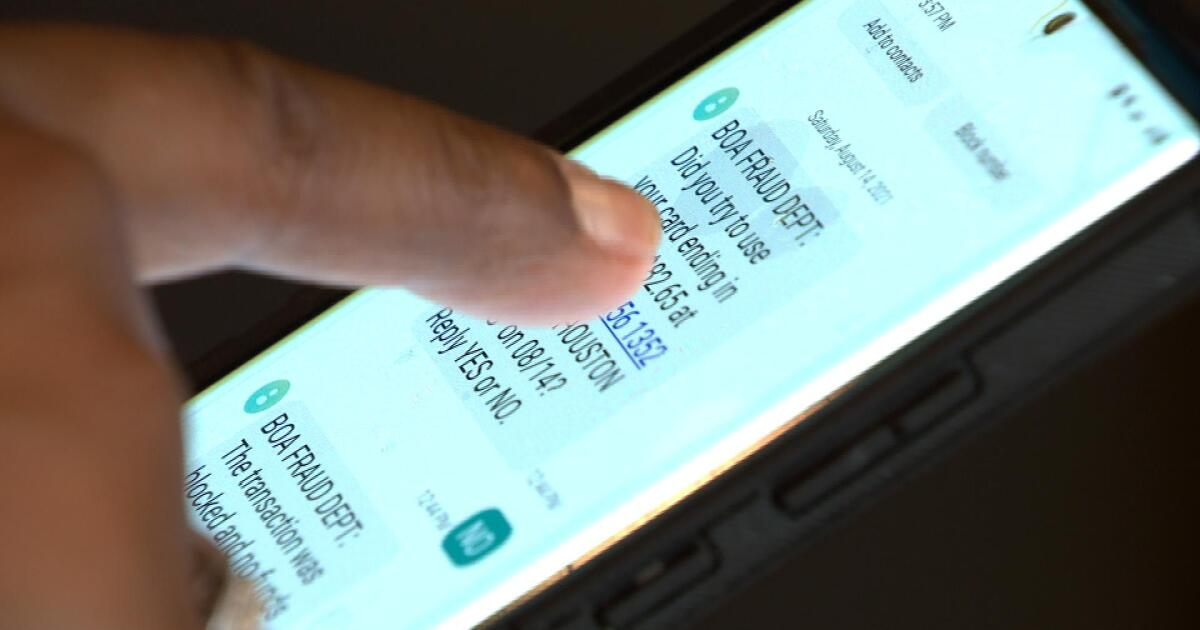

For interview wey Punch Nigeria share, CITN Chairman Ben Enamudu clear say people don dey fear unnecessarily after rumour spread say government go dey cut money from una account anyhow. He yan say your money wey dey inside bank no be tax — tax only dey when person transfer money from one account to another.

According to notices wey banks don begin send customers, sender go now pay ₦50 stamp duty for electronic transfers wey pass ₦10,000 — and na only when you dey send am go another person or another bank account. Transfers under ₦10,000, salary payments and transfers between your own accounts for same bank no go attract this charge.

This new stamp duty system replace old Electronic Money Transfer Levy (EMTL), and now government dey try make am more transparent as dem shift the charge from receiver to sender — in line with broader tax reform effort.

Some analysts and banks don already begin explain to customers how this new rule go work, and dem reassure that no tax go dey deducted directly from una bank balances, no matter how much money dey there.

But as this new rule dey start, many Nigerians still dey wonder whether this ₦50 charge go affect their daily transactions, especially small businesses and people wey dey use bank transfers every time. Others dey praise am say e go clear confusion about who go pay tax for digital transfers.